There has been contention amongst macro-economists as to whether the world has already surpassed peak inflation, or if the worst is still to come. The latest CPI figures of 8.5% gives a glimmer of hope that the worst is behind us. So how will the real-estate market react in the next months to come?

Unfortunately it isn’t as simple as relying on catching the inflation peak. For the asset classes that have had a significant amount of correction to-date, there may be short-term reprieve before reassessment on long-term outlook. Real-estate however, has had minimal downside and its reactions normally lag months behind its risk-on counterparts such as stocks and digital assets. The real-estate market has had mainly the slowing of growth in the recent months, with the market signalling a potential correction to come.

Even though the inflation may have peaked, the YoY CPI of 8.5% is still far higher than what the reserve bank considers as normal. For this very reason, more rate hikes are extremely likely in order to bring inflation down to a more reasonable level. As the official cash rate is expected to continue on its upwards trajectory, this translates to more pain to come for those that are already under mortgage stress. This will also push prospect home-buyers to think twice about taking on debt, as it is likely to get a lot more expensive in the short-medium term.

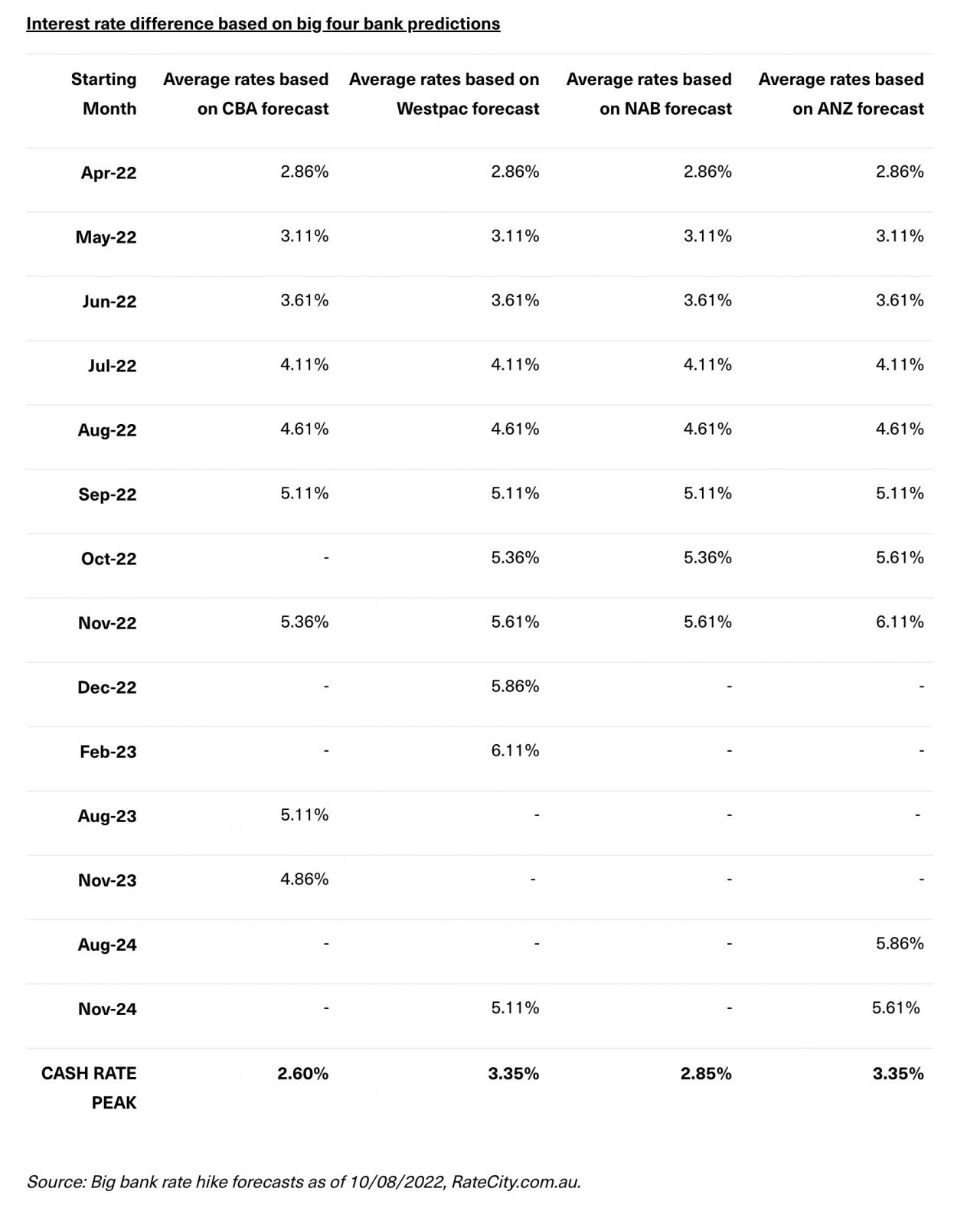

The elephant in the room however, is that the official cash rates will continue to rise into the foreseeable future. The below table shows the forecast from the big 4 banks in Australia, which indicates just how expensive things may get for those with mortgages.

For those over-leveraged, they may actively look for an imminent exit as affordability becomes an issue. Buyers requiring finance will inevitably delay their purchase as these forecast numbers will spook any first home owners and investors. As demand falls and supply rises, a market correction is hard to avoid.

This is good news for liquidity-rich parties looking to scoop up a bargain, whilst tricky for the rest of us. Exercising patience in this market is a wise move. Whilst there’s a major shortage of contractors, supply chain disruptions for raw materials, coupled with tricky market dynamics, sometimes the best move is no move.