As Australians continue to experience rates hike after hike, mortgages are becoming increasingly unaffordable for the majority. Even with the latest hikes and declining property prices, it is nonetheless still well above pre-pandemic levels. The affordability of real-estate is getting sandwiched by the generally high prices and expensive mortgage repayments. When will we tip over the equilibrium and see a steeper correction in the Australian Real-estate market?

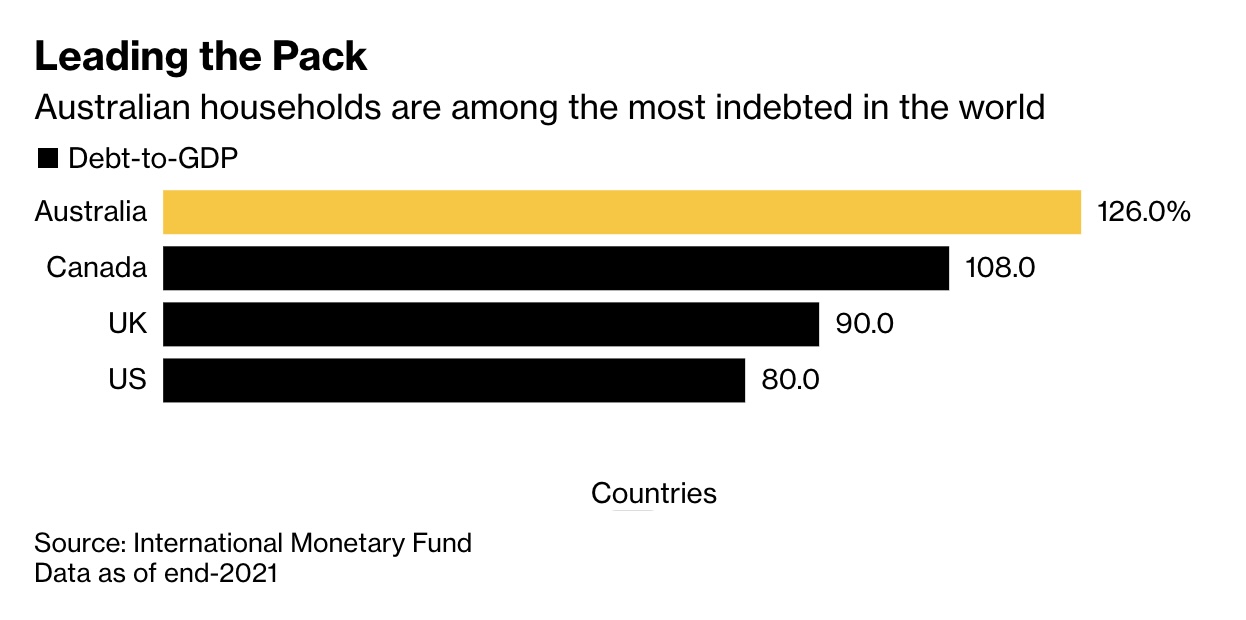

Australia, being one of the countries with the highest debt-to-GDP ratios, are much more sensitive to rate fluctuations. The domestic property market has also survived the 2008 GFC relatively unscathed. In fact, the last time Australians experienced a double-digit correction within a 12-month period goes way back to the 1990s. All the above and many other technical indicators point to a bigger correction to come in the next 12-24 months as the RBA foresees continuation of hikes until Q2, 2023 at minimum, before slowing.

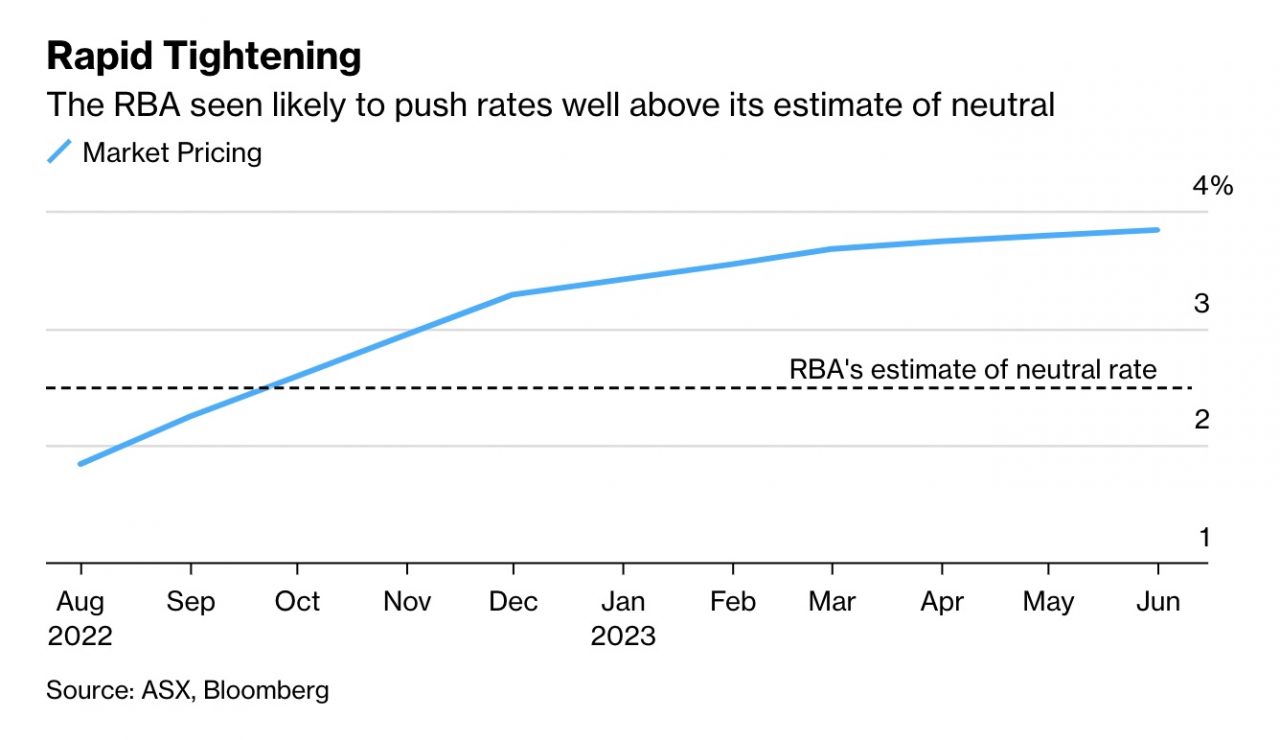

The RBA however, recognises that it is walking on a fine line. Squeezing too hard will solidify and deepen the recession, but not enough means that income will continue spiralling out of control. This delicate balance can only be preserved for so long, as borrowers feel the burden of mortgage repayments and general living costs, both of which are on a steady incline. Rapid tightening is forecasted to go well beyond the estimated neutral rate, extending the hike period well into the second half of 2023 before any signs of plateau.

Investors and home owners are finding themselves in a peculiar position; the global supply chain and labour shortage has yet to be fully contained, whilst on the other hand a much steeper market correction is potentially around the corner. Risky market outlook normally calls for risk mitigation strategies, and for those over-leveraged investors, it could be time to consolidate and mitigate. For home owners, assuming one is not over-leveraged, sometimes the best strategy is do nothing and stay put, until such time the supply chain and labour disruptions stabilise.

For jobs that require priority though, do get in touch with Simply Frameless to see how we can help.